Why work in Luxembourg while living in France?

Work in Luxembourg and live in France is a choice that 124,000 border workers do every day. Why? Because this union offers a lot of financial and practical opportunities.

The Grand Duchy has been attracting cross-border workers from France for a very long time and for several reasons:

- The high salaries

- a dynamic job market

- the possibility of working at the European headquarters of international companies

- career opportunities.

On average, 47% of workers in Luxembourg are cross-border workers. Among them, half live in France and travel to the Luxembourg region on a daily basis.

The advantages for French workers of coming to Luxembourg

Higher salaries

First of all, Luxembourg is very well known for offering attractive salaries: according to the Indeed platform, the monthly gross minimum wage in Luxembourg is on average fixed at €2313.98 compared to €1678.95 in France. A difference that can be increased by 20% depending on whether the type of position is more qualified, depending on your profession or the company in which you work.

Regarding taxation, French workers working in the Grand Duchy benefit from a tax rate according to the Luxembourg scale, which is often more favorable than French, especially for higher income groups. Social security contributions are generally lower in Luxembourg.

For unemployment, as pointed out by Unédic, a cross-border worker residing in France benefits from unemployment benefits identical to those he would have received if he had worked in France, although unemployment insurance contributions were not paid in France but in the State of employment.

A dynamic professional ecosystem

Luxembourg is the economic heart of Europe: the country is home to numerous multinationals, especially in the IT sector, (Google, Microsoft, Apple, IBM), finance (Banque de Luxembourg, BNP Paribas, PWC, etc.) or even health (Bionext, B Medical Systems, Laboratoire Ketterthill, etc.) or even health (Bionext, B Medical Systems, Laboratoire Ketterthill).

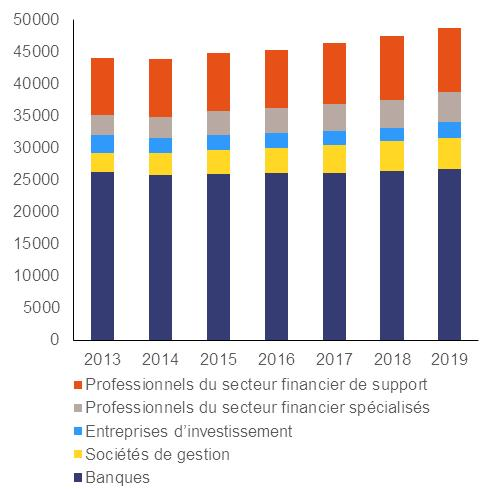

In addition, The financial sector accounts for 25% of the country's GDP. An ideal environment when you want to work in a company with an international challenge.

Geographical proximity

Most French border workers come from Lorraine. Luxembourg is located about 50 minutes from Thionville, 1 hour from Metz and 1 hour 45 minutes from Nancy, which offers daily travel facilities.

However, with 124,000 cross-border workers, car travel can take longer, especially during peak hours (see below). Thus, many workers decide to take the train to go to the Grand Duchy.

The challenges of life for a France-Luxembourg border worker

To have only advantages would be too good to be true, and cross-border living also has its share of disadvantages.

Here are the different challenges of living in France and working in Luxembourg:

Daily trips

Who says 1 hour of travel says 1.5 to 2 hours with traffic jams, which can be a lot of daily time in transport.

There are also the costs associated with these trips: fuel, vehicle maintenance or public transport subscriptions. Count on several hundred euros per month regardless of the transport used.

To make traveling from France to Luxembourg more pleasant, some people do not hesitate to take public transport:

- Carpooling: by sharing a vehicle, you will also share transport costs and you will reduce the number of vehicles on the roads. You can register on carpooling service sites such as BlaBlaCar Daily, La Roue Verte or Karos if you want to share your trip.

- Take the train: the train is a must when doing France-Luxembourg work. No traffic jams, no parking problems, many French residents have chosen this transport. <

Work-life balance

Between the time spent in transport and the hours in business, we necessarily spend less time in sports activities, or family adventures. In this case, year after year, fatigue sets in, stress too, and it can be difficult to have a balanced professional and personal life.

Double taxation and social security contributions

French cross-border workers who work in Luxembourg are subject to Luxembourg income tax, which is levied at source. But it is important to declare this income in France: in this case, you will avoid double taxation thanks to a tax credit granted by the French tax authorities.

With regard to social security contributions, in general, cross-border workers contribute to the security system in the country in which they work. If a French resident is employed in Luxembourg, he will contribute to the Luxembourg social security system, which gives him rights in terms of health coverage, insurance, pension and social benefits in this country.

Make sure you have adequate social coverage to avoid any surprises.

Our advice for a successful life as a cross-border worker in Luxembourg

As you can see, working in Luxembourg and living in France is as much a new opportunity as it is a challenge.

Here are our tips to make your daily life pleasant when you are a cross-border worker

Choosing the right location in France

Choosing the city of residence will determine your quality of life. Some cities are popular with border residents:

- Thionville : located about 30 km from Luxembourg, many cross-border workers live there thanks to its fast rail connections and direct access to the A31 motorway.

- metz : further away (50 km), Metz offers a more developed cultural life and a more diversified real estate market. Cross-border workers who opt for Metz benefit from a pleasant living environment while having access to public transport to Luxembourg.

- Longwy : this border town allows quick access to Luxembourg while remaining more affordable in terms of real estate prices.

- Verdun and surroundings : some cross-border workers choose more remote cities to take advantage of a quieter living environment and lower rents, despite longer trips.

You have to find a balance between travel time and quality of life: the more remote a city is, the more savings on housing are synonymous with transport costs and fatigue associated with daily trips.

Optimizing trips

One of the major challenges for border workers is transport management. Luxembourg has put in place several solutions to limit traffic jams and encourage alternatives to private cars:

- Regional trains : there are railway lines connecting Metz, Thionville and Longwy to Luxembourg, which allows you to save time and avoid morning and evening traffic jams.

- Park-and-relay : for cross-border workers who prefer to take their car to the border, Luxembourg offers several free car parks and relays, where they can then use free public transport to reach their workplace.

- Carpooling : platforms like Blablacar Daily facilitate carpooling between cross-border commuters, thus reducing travel costs.

Given the time spent in transport, the costs associated with commuting can be significant: gas, tolls, vehicle wear and tear or public transport subscriptions.

To better manage these expenses, you can:

- Make a tax deduction: in France, cross-border commuters can benefit from a flat deduction on mileage expenses, depending on the distance traveled.

- Adapt your work schedules to avoid peak hours if your business allows it.

- Some Luxembourg employers contribute to the transport costs of their cross-border employees, in particular for train subscriptions.

By optimizing the choice of place of residence and routes, it is possible to significantly reduce your financial and logistical impact, and take full advantage of the advantages offered by this situation.

Reside in France or Luxembourg

Living in Luxembourg: advantages and disadvantages

Living in Luxembourg is also a solution: it allows you to be as close as possible to your work and to avoid long daily trips.

But this option remains difficult to access due to the high cost of real estate and a very tight housing market.

The advantages of living in Luxembourg:

- Time saving: no long daily trips to manage.

- Attractive taxation: residents have Luxembourg tax advantages and do not need to manage double taxation.

- Quick access to infrastructure: proximity to schools, hospitals, and free public transport.

- Professional opportunities: you will have more flexibility to change jobs or advance in your career.

The disadvantages of living in Luxembourg:

- Housing is very expensive: the average price per square meter in Luxembourg City exceeds €10,000 compared to around €3,000 to 4,000€ in Lorraine on the French side.

- Difficulty finding housing: demand is much greater than supply, making it difficult to find real estate.

- High cost of living: The prices of everyday consumer goods and leisure activities are higher in Luxembourg than in the neighbouring country.

- Fewer social benefits: some benefits are less accessible to residents compared to France.

Conclusion

Working in Luxembourg while living in France is an attractive opportunity for many cross-border workers. Thanks to higher salaries and a dynamic job market, the Grand Duchy offers interesting prospects in several sectors, including finance, IT and health.

However, this situation presents challenges, especially in terms of travel time, taxation, and work/personal life balance.

To make your choice, we advise you to evaluate your travel time, to fully understand the tax conditions, and to optimize your remuneration according to the Luxembourg tax rate.

The housing market and the quality of life are also factors to take into account, as prices per square meter are much higher in Luxembourg than on French territory.

Whether you choose to live in Luxembourg or in France, the Grand Duchy remains a destination of choice for developing your career and benefiting from an attractive economic environment.

To discover numerous job offers, do not hesitate to check out the latest job offers in Luxembourg on Alleyesonme.jobs.

Frequently asked questions

Is it profitable to work in Luxembourg while living in France?

Yes, working in Luxembourg while living in France is profitable due to higher salaries and a lower cost of living in France. The disadvantage is mainly in terms of travel time, transport costs, and the management of double taxation.

What are the tax advantages for French people working in Luxembourg?

French workers in Luxembourg are taxed at source in the Grand Duchy, which benefits from a more advantageous tax scale than in France. To avoid double taxation, you can benefit from a tax credit.

What are the French cities near Luxembourg?

The cities that border residents choose the most are Metz, Thionville, Thionville, Longwy or Nancy, each with their advantages and disadvantages, but also their good living conditions between proximity to the neighboring country and quality of life.