Working in Switzerland or Luxembourg... what is the best choice for cross-border workers? Each year, these two countries attract thousands of professionals in search of opportunities and, above all, a better quality of life.

While Switzerland is renowned for its high salaries, Luxembourg is just as much appreciated for its tax advantages and its proximity to France and Belgium.

Beyond the numbers, there are other elements to take into account: working conditions, cost of living, health insurance... As a cross-border worker, are you going to give priority to job offers from the Grand Duchy or those from Swiss cantons such as Geneva? What sectors are recruiting the most? What are the differences in terms of remuneration, social security contributions, environment?

In this article, we offer you a detailed analysis to make the best professional choice.

The job market in Switzerland and Luxembourg

Sectors that are recruiting

In 2024, Switzerland is facing a shortage of qualified workers in several key sectors. More than 100,000 jobs remain unfilled, mainly in the following areas:

- Health: the demand for medical personnel is constantly increasing, especially for positions for nurses, doctors or paramedics, due to the aging of the population.

- Technology: Businesses are actively looking for IT specialists (data scientists for example), to meet the growing needs of digital transformation.

- Tourism and hotels: with the recovery of this sector following covid, the restaurant and hotel trades are particularly in demand (waiters, chefs, etc.)

- The manufacturing industry: the watch making, construction and mechanical engineering sectors are also looking for qualified professionals.

In Luxembourg, the job market is quite dynamic with demand from several sectors:

- Finance and accounting : Luxembourg is a major international financial hub. Naturally, the country is constantly looking for experts in finance, accounting and auditing.

- technology : the Grand Duchy is becoming an important European startup hub, as well as in providing assistance to support the digitalization of businesses.

- Health : health professionals are in high demand to meet the needs of a growing population.

- Business services : there are a lot of opportunities in the areas of human resources, legal advice and accounting.

As you notice, the first way to make your choice is to determine what profession you want to work in! In both cases, the border community working in one of the two countries will easily have a career. Both countries offer very attractive job categories, for anyone looking for perspective across the border.

Working conditions

Let's start with Switzerland. Working conditions are renowned for their flexibility and attractiveness:

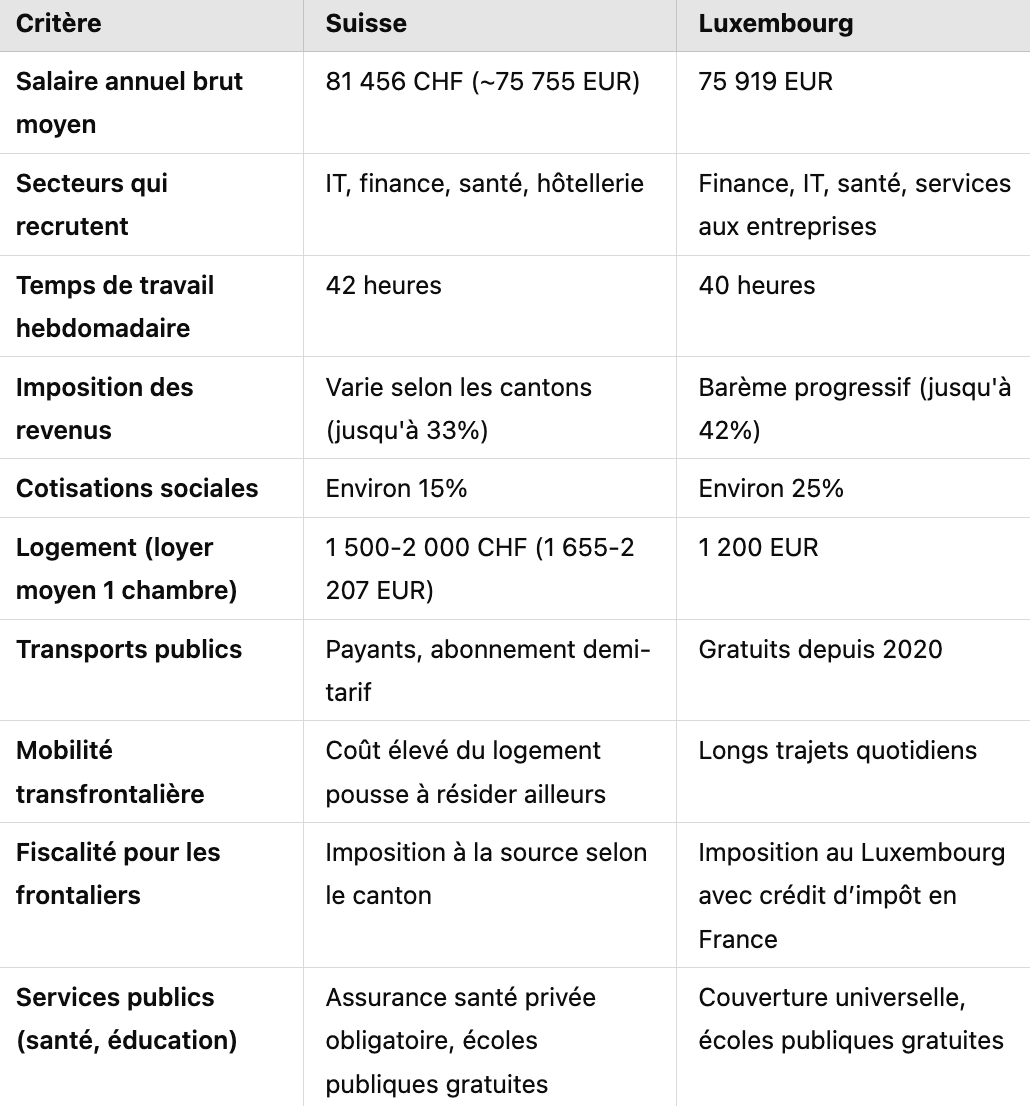

- Working time: the average weekly working time is around 42 hours, varying between sectors and collective agreements.

- Les employment contracts generally include a trial period. The duration is determined by agreement between employer and employee.

- Teleworking: since January 1, 2024, cross-border workers can up to 25% of their time working from home without fiscal impact. They remain taxed in the employer's country.

In Luxembourg, you will have attractive working conditions with recent reforms to improve transparency:

- As far as working time is concerned, the legal duration is set at 40 hours per week, with the possibility of overtime under the law.

- As far as contracts are concerned, there is a new legislation dating from 4 August 2024 requiring employers to provide detailed information on working conditions in contracts.

- Regarding teleworking, the modalities for cross-border workers are subject to bilateral agreements and may vary depending on the employee's country of residence.

Wages and taxation: Switzerland or Luxembourg?

Wages

Salaries in Switzerland are on average higher than in Luxembourg. The cost of living is also higher.

- Technology: 95,000 CHF/year (88,350 EUR) in Switzerland vs 60,000 EUR/year in Luxembourg

- Finance: 120,000 CHF/year (111,600 EUR) in Switzerland vs 80,000 EUR/year in Luxembourg

- Health: 70,000 CHF/year (65,100 EUR) in Switzerland vs 55,000 EUR/year in Luxembourg

Wage differences are explained by differences in the cost of living and taxation. The Euro is stronger than the CHF but Switzerland remains above in terms of wage income.

Tax differences: tax rates in Switzerland vs Luxembourg

In Switzerland, the tax system is decentralized. You will have federal tax (up to 11.5%) as well as cantonal and communal taxes (up to 33%). There are social security contributions of around 15%, shared between the employer and the employee. French border workers are taxed at source with specific agreements depending on the canton.

In Luxembourg, there is a progressive tax over 23 brackets, with a maximum rate of 42%. Social security contributions are around 25%, equally divided between employer and employee. For cross-border workers, the tax is levied in Luxembourg, but a tax credit is granted in France to avoid double taxation.

Even if Swiss salaries are higher, Luxembourg taxation and its more affordable cost of living make both destinations attractive according to individual priorities.

Cost of living and quality of life

Housing: rents and real estate costs

In Switzerland, the cost of housing is among the highest in Europe. In Zurich, for example, the monthly rent for a one-bedroom apartment is between 1500 and 2000 CHF (1600 and 2125 EUR). Public services, such as electricity and water, cost around CHF 150 per month.

In Luxembourg, the cost of housing is also high, but less so than in Switzerland. In fact, in Luxembourg City, the monthly rent for a one-bedroom apartment is around 1200 EUR. Public services average 230 EUR per month.

Transport: travel expenses for border workers

Switzerland is renowned for the efficiency of its transport. There is a half-fare subscription that allows you to travel at half price (190 CHF/year). 3 million Switzerland adopted it in 2022.

In Luxembourg, public transport has been free since 2020 throughout the country, a unique initiative in the world! For cross-border workers, travel expenses may be tax deductible.

Services and daily life: schools, health, leisure

Unsurprisingly, Switzerland is also renowned for its very high quality education system, with free public schools and fee-paying private institutions. Health care is excellent there, with compulsory insurance that costs an average of CHF 300 per month.

In Luxembourg, the services of daily life are also very efficient: the country offers free public schools and very high quality health services. Residents benefit from universal health coverage.

The advantages and disadvantages for cross-border commuters

In Luxembourg, cross-border workers are taxed at source, avoiding double taxation thanks to tax treaties with France, Belgium and Germany. There is a progressive tax system with 23 tax brackets, ranging from 0% to 42%. Travelling to the Luxembourg region can be complicated, they are long daily trips, often in traffic jams.

For Switzerland, taxation varies according to the cantons: in Geneva, cross-border workers are taxed at source in Switzerland, while in other cantons, taxation is made in the country of residence. The overall tax rate can be up to 33% (depending on the canton). In terms of mobility constraints, workers often live in neighbouring countries due to the very high cost of housing.

One of the advantages of working in these countries is also the superannuation ! The border community that has contributed in Switzerland and Luxembourg can benefit from a retirement pension from each country, in proportion to the time worked in each country. In Luxembourg, the legal retirement age is 65, with the possibility of early retirement as early as 57 under certain conditions. In Switzerland, the retirement age is 65 for men and women, with a system based on three pillars: AHV (Old-Age and Survivors Insurance), occupational pension (LPP) and individual pension provision. The contribution periods in each country are added up for eligibility, but each state pays its pension share according to its own framework.

In both cases, there is a real desire to protect residents and cross-border workers working in companies.

Testimonies and feedback

On the borderliers.lu exchange forum, Sarah talks about her experience:”After more than 20 years in Luxembourg, I went to Geneva 2 years ago and came back to Luxembourg. In both cases I went border. For my part, there is no photo, Luxembourg is better, no exchange rate impact, no social security to pay privately, the prices are not as exorbitant as in Switzerland (I'm talking about leisure and shops). For me Luxembourg is a much more welcoming country than Switzerland (it's just my opinion everyone has their own experiences). After all, it is certain that from a weather and activity point of view, Geneva and Haute-Savoie have nothing to do with Luxembourg and Lorraine, but it is difficult to have everything.”

Comparative table: Switzerland vs Luxembourg

After listing all the information between Switzerland and Luxembourg, here is a summary of the main concepts to remember:

Frequently asked questions

What are the tax advantages for cross-border workers in Luxembourg?

Cross-border workers are taxed at source in Luxembourg, thus avoiding double taxation thanks to tax treaties. Deductions and deductions are possible for certain professional and transport expenses.

Are salaries higher in Switzerland than in Luxembourg?

Salaries in Switzerland are higher than in Luxembourg. However, taxation, social security contributions and the higher cost of living in Switzerland can reduce this difference in terms of income.

Is the cost of living in Luxembourg really lower than in Switzerland?

Overall, yes. The cost of housing, services and health is much higher in Switzerland. However, some expenses such as food and catering remain relatively similar between the two countries.

If you want to work in Luxembourg, do not hesitate to discover a large number of job offers on AlleyesOnMe.Jobs.